After simulating market conditions to a group of investors, researchers at Virginia Tech Carilion Research Institute and Caltech have found that the brain patterns of high earners were different from others. The former were able to predict market bubbles in which the price of something differed greatly from its actual value, a new study published in Proceedings of the National Academy of Sciences reveals. "Stock market bubbles form when people collectively overvalue ...

After simulating market conditions to a group of investors, researchers at Virginia Tech Carilion Research Institute and Caltech have found that the brain patterns of high earners were different from others. The former were able to predict market bubbles in which the price of something differed greatly from its actual value, a new study published in Proceedings of the National Academy of Sciences reveals. "Stock market bubbles form when people collectively overvalue ...The Great Place for all lake forest health and fitness | island health and fitness | health and fitness blogs Health and Fitness Blog Information and News.

Tuesday, 8 July 2014

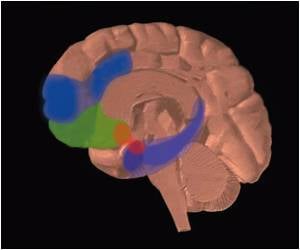

Brain Patterns in High Earners Show They are Able to Predict Market Bubbles

After simulating market conditions to a group of investors, researchers at Virginia Tech Carilion Research Institute and Caltech have found that the brain patterns of high earners were different from others. The former were able to predict market bubbles in which the price of something differed greatly from its actual value, a new study published in Proceedings of the National Academy of Sciences reveals. "Stock market bubbles form when people collectively overvalue ...

After simulating market conditions to a group of investors, researchers at Virginia Tech Carilion Research Institute and Caltech have found that the brain patterns of high earners were different from others. The former were able to predict market bubbles in which the price of something differed greatly from its actual value, a new study published in Proceedings of the National Academy of Sciences reveals. "Stock market bubbles form when people collectively overvalue ...

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment